For those of you in the south…Who loves shopping at Publix!? This is not a commercial. They do this great marketing promotion: BOGO. You perceive that you are getting a great deal by buying the first at full retail price and getting the second for free. We could get into the details of the pricing and what this really means to your budget, but I really have a different point and may have to come back to this later.

The real point is that Cheerios were BOGO last week. Cheerios has a prize in the 12.5oz box: Star Wars character spoons. I typically buy Cheerios at SAMS, but since it was BOGO at Publix and I get a spoon with every box that size, I bought 3 boxes at Publix. Good job, Publix!

Hold on a minute…I’m almost to the point. I forgot about the spoon this morning…until I went to open a new box and saw the picture on the box. I suddenly got excited and nervous. Which spoon would I get? Which spoon did I want? Why am I so excited to get a prize from a cereal box?

I started looking at the numbers. The Publix deal was $0.156 per ounce. SAMS is $0.143 per ounce. Again… Why did I want to pay more for the cereal at Publix? First, I was at Publix. I didn’t want to go to SAMS that day…and I needed cereal. Second: THERE IS A STAR WARS SPOON IN THE BOX!! I was willing to pay the price to get the prize.

Over the last few months, I have reviewed many different practices’ billing numbers. With many of these practices, I have also had a chance to compare industry standard billing services rates to what these practices are paying in house for their billing.

First, I looked at lag times during the following steps:

- Progress note lock to claim creation

- Claim creation to insurance first submission

- Insurance first submission to insurance first payment.

I also looked at claim status aging and last activity aging.

Claim status aging is the system status assigned to a claim by the user: pending, submitted, clearinghouse accepted, clearinghouse rejected, insurance accepted, insurance rejected, payer denied, patient, and various other process statuses.

Last activity aging looks at the last activity date on the claim: claim created, claim last submitted to insurance, claim last submitted to patient, claim last payment, and last user note on the claim. We have found that the highest payment rate on a claim requires activity or follow-up on a claim every 20-30 days, so I monitor claims without activity over 30 days.

I started to see some trends:

- Small practices that have part time billers, long lag time, and high claim status and activity aging. This means that claims are created and submitted once or twice a week and rarely followed-up with the insurance on slow pays or repeat denials.

- Medium and large practices that have full time billers, short lag time, and high claim status and activity aging. This means that claims are created and submitted daily, but rarely followed-up with the insurance on slow pays or repeat denials.

With the majority of the practices I reviewed, the billing process was short staffed. They were not spending the industry standard on billing services. This short staffing has created a process focused on the low hanging fruit. This typically manifests itself in increasing Insurance AR over 120 days and an increase in Insurance AR days (if you don’t have a standard write off procedure).

Of course there is always the question of how much do you spend to collect that final 25-30% of claims from the insurance. If you know how much it costs you today and you see how much you are not collecting, you can calculate how much more revenue you will bring in. Even if you collect 2% above the cost of the billing resources to collect it, you are still making an additional 2%. Why let the already wealthy insurance companies keep the money to which YOU are ENTITLED?

Earlier this year, we had a customer come over from another billing service. It turned out that the other billing service was not verifying that all of the hospital charges were getting filed in a timely manner. By the end of the first quarter on our service, their receipts were up 28.6%. That was their best first quarter ever.

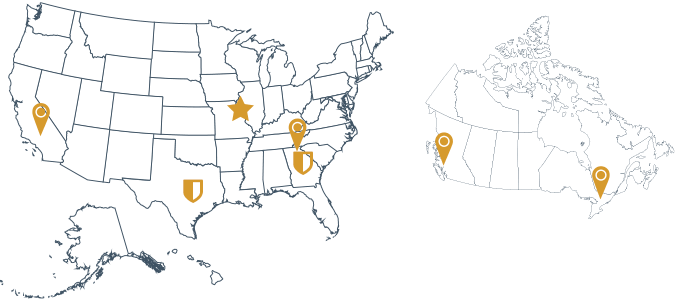

RCM360 has the expertise, process, and technology to maximize collections and keep following up on the outstanding insurance claims. We are transparent in our analytics and reporting, doing the billing in YOUR ECW system. You can see everything we do, therefore we are accountable to you. We earn your business every month and build long lasting relationships with our clients.

What is your Star Wars spoon? Are you willing to pay the price to get the prize?