I have been driving in Florida for almost a year and a half now. I am amazed at how some of the drivers down here are still alive. There are the turtles and the hares, but what is the really concerning habit is the last minute 4 lane changers. This happens stopped at a stop light. This happens on the highway going 80.

I have been thinking about this for many months after seeing this happen on the highway within 50 yards of an exit. A car STOPPED in the far left lane before crossing the 3 lanes of traffic. I just about soiled myself as I came up on the stopped car. I wonder what causes this person to think that they should cut across these lanes of traffic at the last second, risking, not only their life, but everyone’s lives around them (especially at 80 miles per hour). I consider reasons such as selfishness, ignorance, and not knowing where they are going. I came to the conclusion that this is poor planning and lack of attention to where they are. They just are not paying attention to what they are doing.

What happens when this is your business? Let’s talk about what impact a single claim denial has on your business:

- You submit the claim.

- You wait. Depending on the automation you have built into your practice management system, you may wait a day (for electronic response) or weeks (via paper EOB) for a response from the payer to determine that you have a denial.

- You receive the denial.

- Your biller takes time to research the denial, possibly call the payer directly, possibly contact the patient to get updated information.

- The biller then must correct the claim and resubmit.

- The payer response clock restarts, back to the beginning of the process …

Now we are sitting at anywhere from 3 days to 6 weeks total from initial claim creation! But it doesn’t end there:

- What if the provider is slow at finishing their note (timely filing is from the service date)?

- What if the billing staff is slow at completing and submitting claims?

- Are you getting close to timely filing or appeal deadlines?

The financial impact of this single claim may not be large, but what do you think the financial impact is to your practice if 25% of your claims are denied? How much cash and credit reserves do you have to support a payment delay?

An article by MGMA (MGMA Connection – Tina Graham, Feb. 2014 You might be losing thousands of dollars per month in ‘unclean’ claims. ) showed that nearly 25-30% of lost medical practice income is attributed to improper billing. If a practice is losing 25% of income, what are the most common reasons? We found that before we start billing for a practice the top denial reasons are pretty standard across all practices: Eligibility, Demographics, Prior Authorizations, and Improper Coding.

If you read my last post, I discussed the most common #1 reason for denials: ELIGIBILITY. Refer to “Who’s #1?” for more discussion on Eligibility. How do you prevent these denials from happening? First, you have to recognize the denials are happening. Then you must identify the specific reasons for these denials and make a plan to address the issue. You must train the staff so that they can properly implement the plan. Finally, you must monitor progress, both at a team and an executive level. If you don’t monitor the progress, you will continue to propagate the issue.

We recently had a payer start denying all of a specific common CPT code at a practice. First, we had to know that this was happening. Because we monitor denial trends closely using our custom built reporting and analytics, we were able to catch this trend in a matter of days. Our billing lead then contacted the payer to determine the cause and proper coding. We then identified the resolution. Since the provider was doing the coding in the progress note, we determined the best resolution was to create a rule in eClinicalworks to substitute the CPT when the incorrect CPT was selected. We also ran a report of all outstanding claims with that CPT and had our billing staff correct and resubmit each claim. We continue to monitor the denial trends to make sure the issue is resolved.

So ask yourself:

- Do you know what your top denials are?

- Do you know what your lag time is for each step in the billing process from service date to insurance submission, from insurance submission to payment, etc?

- Do you know what your claim activity aging is (how many days on average since last activity on a claim)?

- How do you identify potential issues in your billing process?

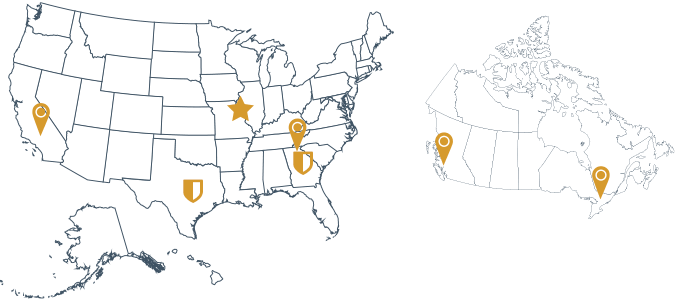

I know I’m throwing out a lot of questions, but these are all questions I ask myself as I’m managing RCM services for our clients. We monitor the trends in your billing data and we know how to right the ship. I know I didn’t like the feeling I had when that car stopped in front of me on the highway to cut across 3 lanes of traffic. I don’t want to feel that way with my business and I’m sure you don’t want to either. RCM360 can help you see where you have been and get you where you need to be. In conclusion, I’ll leave you with this famous quote from Austin Powers: “Who does #2 work for?”